An installment loan can be used to obtain personal or commercial loans. This is a loan that allows you to borrow a fixed amount. You must decide how much money you will need to borrow before you can get a credit card, credit line, or credit card. Get personal loans @ MYFUNDINGCHOICES.COM

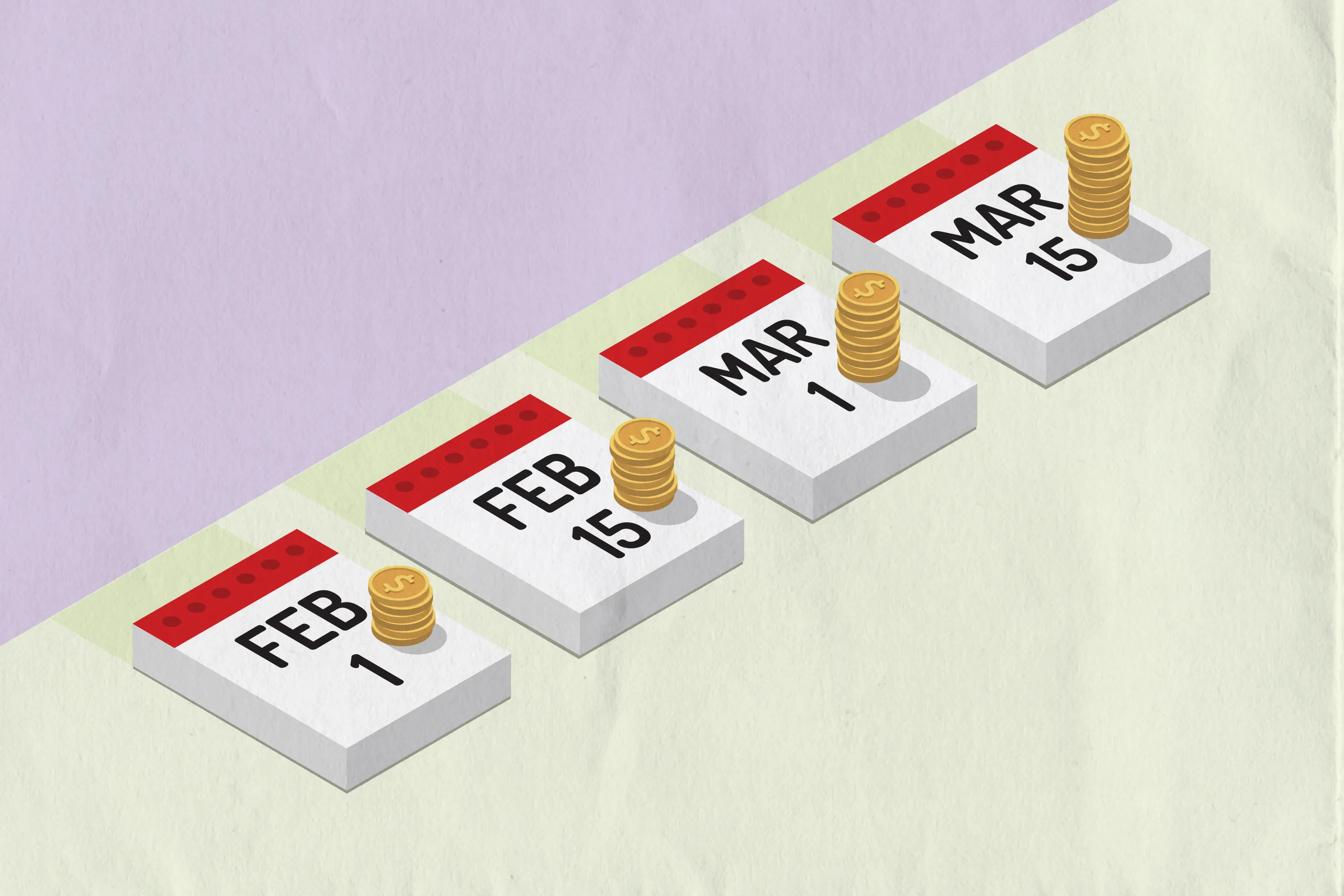

Before you can get your loan, you agree on a repayment schedule with your lender. Although it is common to pay monthly, some agreements may be different. Each payment is called an installment. This is why an installment loan is also known as a loan. Each payment includes the principal amount borrowed as well as the interest.

A repayment period for an installment loan could be several months or even years. You can choose to have the interest rate fixed or adjustable. This means that it can change between higher and lower over the loan term. Additional costs such as application fees or late fees might be included in installment loans. To understand exactly how much you will need to repay, it is important to read the loan contract before applying for a loan.

There are two types: unsecured and secured installment loans. Unsecured loans do not require collateral. All that is required is a promise to repay the debt. You can think of personal loans, medical debt, and credit cards. Secured installment loans are secured by an asset equaling the amount borrowed. Secured loans include car loans and mortgages.

What's the Difference between Short-Term Installment Loans and Long-Term?

You might consider a loan if you need extra cash. How do you decide if you need a loan? Let's take a look at some of the key differences between these types of loans.

These short-term installment loans are often repaid in a matter of months. Long-term installment loans, however, are typically repaid over many years.

The interest rates on short-term installment loans are typically higher than those for long-term loans. This can lead to them costing you more long-term if they aren't repaid quickly.

If you are looking for financing for a major purchase such as a house renovation or a car, long-term installment loans may be an option. Before you sign up for a loan, make sure to compare rates and terms.

Talk to a financial advisor about which loan type is best for you. They will help you to compare the benefits and costs of various loans so that you can choose the best one for your situation.

How to get a short-term installment loan?

A short-term installment loan may be the best option for you if you are in urgent need of cash but don't want to wait for traditional loans to arrive. This is how you can get one.

A short-term installment loan is a loan that you make monthly payments. The entire loan will be paid off at the end of the term. These loans are different from payday loans which typically have a due date of the next payday.

Lenders will determine the amount that you can borrow for a short-term installment loan. However, they usually range between $300 and $1,500. Lenders will vary the terms of the loan, but they are usually three to nine-month-long and repayable with weekly, biweekly, and semi-monthly installment payments.

You will need to complete an application for a short-term, installment loan. The lender will run a credit check to determine if you are eligible for the loan.

Don't be concerned if a credit check is being done on you. Many short-term installment loan lenders will conduct what is called a "soft credit inquiry". This type of inquiry doesn't affect your credit score. This is a good option for people with poor credit or no credit. They could still be eligible, and it won't affect their credit score. You'll be able to choose how much and how long you want to borrow if you have good credit.

After you have been approved for the loan, your money will be deposited into your bank account within one or two business days. To avoid penalties or late fees, you will need to pay your monthly installments on time.

You may be eligible to extend the loan term or get a new loan if you are unable to repay the entire loan. This will likely result in additional fees and interest costs, so only do it if you are certain, you can repay the loan. Get personal loans @ MYFUNDINGCHOICES.COM

A short-term installment loan is a good option if you need quick cash but don't want to wait until a traditional loan comes through. Be sure to compare terms and only take out what you can afford to repay.